Give flex workers and freelancers direct access to their income

Instant payout with Payday

Increase the interest in your digital platform

Over 3.9 million freelancers and flex workers are currently working in the Netherlands, and many of them find jobs through online platforms that facilitate remote work. Despite this flexibility, it takes a long time to fill in hours, approve them, create invoices and get paid. As a result, these 'gig workers' often don't receive their income on time. Payday makes it possible to pay out these gig workers instantly. Instant gratification leads to more filled shifts for your platform, a higher NPS score and an increase in the volume of workers.

Instant payment for gig workers

Pre-financing by Payday enables flex workers and freelancers to get paid instantly for their services provided through your platform

More active gig workers

Offering instant payout will result in more active gig workers executing assignments through your digital platform.

Increased NPS score

Freelancers and gig workers will be happier when you offer them instant gratification. Payday positively impacts your NPS score.

For whom is Payday?

For (digital) labour platforms

Platforms that offer Payday have the benefit of motivated and satisfied workers, more active gig workers and more filled jobs. After integrating Payday via the API integration, it will work as follows:

- Gig workers carry out their assignments with your client

- Your client confirms the hours worked by your gig workers

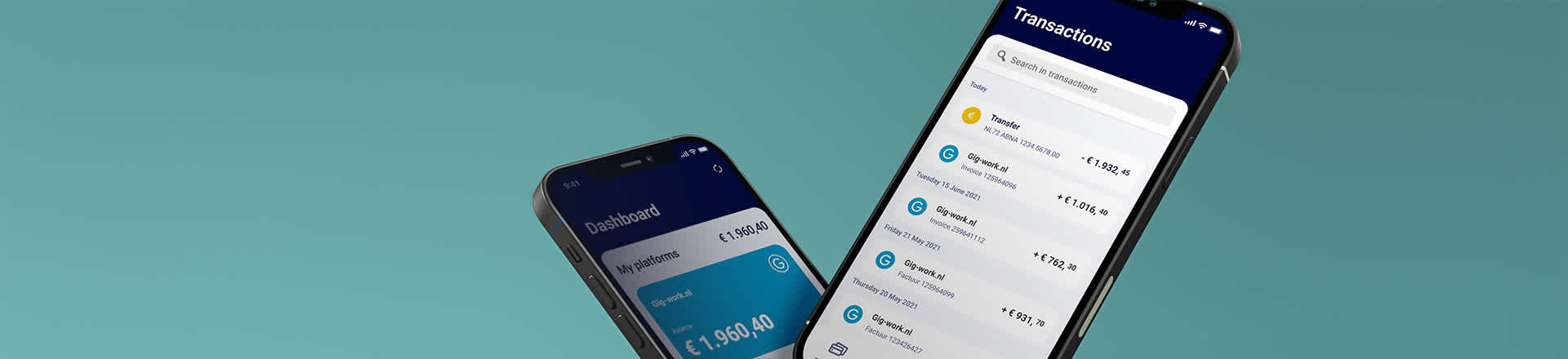

- Gig workers can manage their payments via the Payday app

- You invoice your client for the hours your gig workers worked

For freelancers

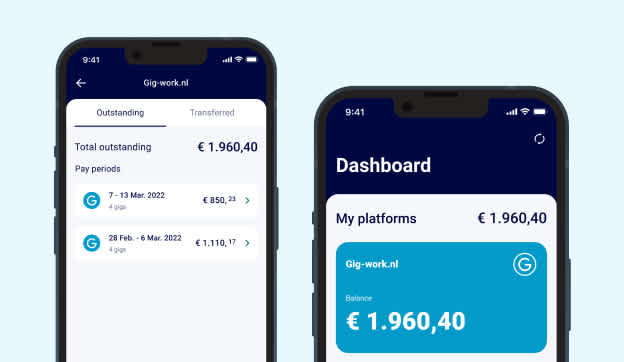

With the Payday app, freelancers on your platform have more control over their pay dates and financial well-being. One can find open and closed invoices, payment details, and income statements.

- No longer having to chase payments of invoices

- 24/7 insight into earnings in a user-friendly application

- Decide for yourself which invoices to pay out immediately

For temporary workers and flex workers

Temp workers and flex workers gain full control over their finances, thanks to the Payday app for temporary workers. They decide for themselves when to instantly payout pay slips.

- Receive notifications once income arrives on the app

- Decide on the amount of the payslip to pay out early

- Insight in a handy overview of gross-net-calculations

How does Payday work for temporary workers?

Watch the short animation video and discover what benefits Payday offers to temporary workers.

- Income already (partially) available in app after hours have been registered

- Temporary worker determines when the salary is being paid out

- Automatic payment of unpaid wage periods

How does Payday work for freelancers?

Watch the short animation video and discover what benefits Payday offers to freelancers.

- Earnings already available in app after invoice has been submitted and approved

- Freelancer immediately gets the option for early payout of the invoice

- Automatic payment of unpaid invoices on expiration date

How does Payday work?

How does the onboarding work?

Receive a non-binding demo

Our specialists are happy to show you a demo of Payday. Discover all features and ask all the questions you have.

Decide if Payday fits your platform

Once we have determined that Payday fits your platform, we will select the most suitable components for implementation.

Sign contract and start development

The implementation starts with a pilot of a few months. The technical details will be realised in your current payment process.

Scale up after a successful pilot

Based on the learnings from the pilot, we improve the process and integrate Payday within your labour platform.

The benefits of Payday

For (digital) labour platforms

- Offer instant payment to your gig workers

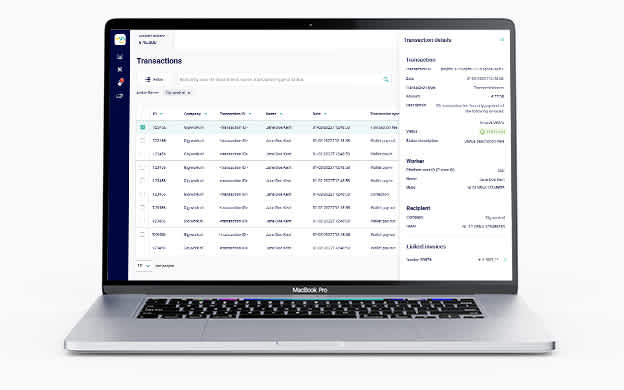

- Payday Admin Panel with all transactions

- Use the instant payment API

- Insight into work behaviour of workers

- Insight into Payday balances

- Automate worker payouts

For entrepreneurs and freelancers

- Notification when income is due/payable

- Decide for yourself which invoice to payout

- Invoice paid within 1 minute

- No more chasing the payment of invoices

- 24/7 insight into earnings

- All in one Freelancer app

For temporary workers and flex workers

- Notification when payslips can be paid out

- Decide for yourself what amount to pay out

- Hours worked paid immediately

- Pay slips are always up to date

- Overview of all gross-net calculations

- All in one Temp-worker app

Is Payday something for your platform?

Platforms that offer immediate payouts see a higher NPS score, more invoices, and an increase in workers. Wondering if instant payment with Payday is something for your platform? Discover it during a free demo.

User experiences

“Instant payment fits perfectly with today's fast-paced society and how young people work. They perform a job today and prefer to spend their earned money the same night. Thanks to this innovation, it is possible. If we can make freelancers happy with this, then of course we will go for it. Direct payment will eventually replace our current factoring option, on the same terms.”

“We are very excited to enter this partnership with ABN AMRO. Our couriers are the heart of Packaly and help our Retail customers every day, whether it is sunny or rainy. With this partnership, we can offer our couriers an exclusive service, allowing them to drive and get paid in the same hour.”