Frequently Asked Questions

Instant payout with Payday

Frequently Asked Questions

Instant payout with Payday

Read the answers to all your questions about Payday here.

General

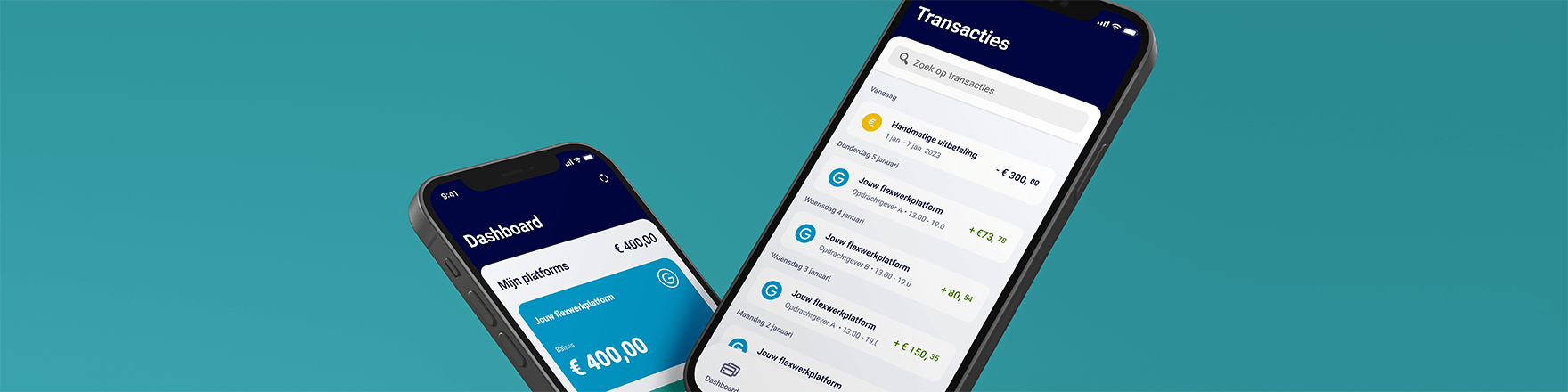

Payday is an Application from ABN AMRO that enables digital flex work platforms to give their freelancers and temporary workers timely access to their earnings. Payday gives you the flexibility to decide when earnings are paid and therefore gives you greater control over your finances. In addition, Payday provides you a clear overview of all your earnings and offers transparency about the dates you will receive which earnings. With just a few clicks, you can have your earnings instantly into your bank account if you choose to withdraw early. Even on weekends!

What is Payday?

With Payday, you get a complete overview of the earnings you receive from your platform. After your worked hours or invoices have been approved by your employer, we will immediately enable a part of your earnings for early payout. If you have enabled Payday’s push notifications, the app will notify you when you will be able to withdraw your earnings. This can be done at any time of the day.

How does Payday work?

Registration

You can sign up if the platform you work for has a working integration with Payday. If so, they will give you a unique code you can use to connect the platform to the Payday App. You can download it here: Payday for Android or Payday for IOS. When you create a Payday account, we retrieve some profile data from your platform, you confirm your bank account number, and voilà! You're done! You will be the newest user on the Payday App and can use all the features right away.

How do I sign up?

Anyone who works for a platform connected to Payday can use the Payday Application. You are not required to have an ABN AMRO account. Payday pays out to all major European banks. Depending on the foreign account number, it may take a little longer, but do not worry: your money is on its way.

Is the platform you work for is not yet using Payday, and would you like to be paid earlier? Let them know about us! You can forward this link.

Can I also use Payday without an ABN AMRO account?

You should receive this automatically from your platform, but if you have not, please contact them. This also applies if your verification code does not seem to work. They know what they can do to help you.

My unique verification code does not seem to work (or I did not receive it)

Instant payout

If you choose direct payment in the Payday App, your income will be in your personal bank account within one minute! This way you do not need to wait until the end of the month to get that new piece of clothing or festival ticket! In exchange, your platform might ask for a small percentage. How much, that depends on the platform you work for.

We understand two types of payouts:

-

Early Payout: You press the payout button to withdraw your earnings early. You may have to pay a fee for this, depending on your platform. With this button, you will receive your income within one minute.

-

Automatic Payout: At the end of your pay period or when the payment term of your outstanding invoice has expired, the outstanding part will automatically be transferred to your bank account. Payday will show you on what day you will receive your open earnings automatically (and free of charge) in case you have not pressed the early payout by that time. (Some platforms disable this function and give you the option to manually transfer your earnings from the Payday Application even after the due date of your invoice or ending of your pay period. Your earnings will then stay on the Payday App until you press the button to pay out. From that moment this payout if also free of charge.)

-

What does an instant payment entail?

Within one minute you will receive your money.

How fast is instant payment?

Yes, you will see a confirmation screen in the Payday App as soon as your payout has been completed. When you have received your earning and you have enabled the notifications from your banking App, you will receive a notification from your bank that the money has been credited.

Will I receive a confirmation when money has been transferred to my account?

A payment that is pending is waiting to be checked by Payday and/or the platform you work for. Think of it as the self-checkouts in supermarkets. Some transactions are extra well checked. In addition, the platform you work for may set limits on the number of payments you can receive per day.

If you exceed the limit for payment, it may take longer than usual to receive your money from us. Those payments must be discussed and processed. If there is a technical issue, do not worry: your money is safe. Every five minutes, we automatically attempt to re-execute your transaction.

If you have not received your income one working day later, please contact your platform. They will help you!

What does “pending” mean and why is my payment “on hold”?

Early payout is always voluntary! We simply want to put you in control of your income as quickly as possible.

Are you freelancing? If automatic payout is enabled by your platform and you have not withdrawn money early, your invoice will be paid to you on the final payment date. After the automatic payment has been made, it will be visible in your financial overview. In some instances, your earning will remain on the Payday App until you get if off yourself.

Are you a temporary worker? Once your pay slip has been finalised (that is, when your net income has been calculated), the remaining balance of the pay period will automatically be transferred to your bank account. Then you will see that your pay period has been finished and paid.

Example: You have taken out €50 early of your total €250 net income. Then you will automatically get €200 at the end of the pay period. Did you not pay out anything early? Then you will receive the full €250 automatically.

Will I still get paid if I do not hit the payout button?

For temporary workers

You can view your pay period in the dashboard under “outstanding” or “completed”. The pay periods show your worked shifts and the structure of your period. This structure contains:

- Early payout: The amount that you have paid out early to yourself via Payday.

- Automatic payout: The outstanding amount that is automatically paid to your account after the pay period ends and your net salary has been calculated.

- Total earnings: The sum of earnings in a pay period you have earned.

- Balance: The amount still available in Payday for early withdrawal.

How can I see which shifts have been paid and which are still outstanding?

If your platform chooses to allow early withdrawal of (a part of) your gross income, this will never be the full 100% of your gross income. This is to prevent you from having to pay back part of your income at the end of the pay period for, amongst others, income tax. Your platform determines the percentage that is available for you to withdraw early.

What percentage of my income can I have paid out immediately?

That varies per platform. If you were previously paid per week, it is likely to still be the same. If you allow Paydays notifications, you will receive a notification when your pay period is complete. In a completed pay period, your net-income calculation is made visible. Any remaining funds will be transferred to you automatically. If you have enabled your notifications of your banking App, it notifies you as soon as the money has been added to your account. For further questions about the content of your payslip, we recommend you contact your platform.

When will my pay period be completed?

You cannot pay out more than is available on your balance, but you might have been given more money than you are entitled to. If you have already paid it out early, your pay period will show a negative balance. But do not worry! Your platform will settle this with your next pay period or contact you personally to settle this amount.

Example: you have withdrawn your available gross income of €100 early, while at the end of your pay period is shows you officially earned €90 net. Your Payday-balance can no longer be deducted since you paid it out in full. In that case, it is possible to have negative Payday-balance. That €10 that you have received too much will be collected from you by your platform.

Can I have a negative balance?

For Freelancers

In your invoice overview, your invoices are categorized by "outstanding” and “paid”. This allows you to see which payments have already been paid and which are on its way. On the final payout date – after a week or after 30 days, depending on your platform and it they have this function enabled – you will automatically receive your earnings. That date is shown in the invoice details. This also indicates how long you have left to withdraw the invoice early.

How can I see which invoices have been paid and which are still outstanding?

It is possible that your invoice or assignment will be changed by your platform or client. You should still, of course, receive the amount you worked for. We settle the difference with any amounts withdrawn early. You will see this as a “correction invoice” in the Payday App. If you have received too much because of an early withdrawal, you will temporarily be on a negative balance. Upon payment of the next payment, this difference will be automatically settled.

Example: you have withdrawn an invoice for €1000 early, while you officially earned €900. Since you have paid out your Payday balance in full, we can no longer deduct your balance. In that case, it is possible to get into a negative balance. The €100 that you have received too much comes back as a negative correction invoice. Do not worry, if that is the case, the negative balance will be settled with your next earnings. Once your balance is positive again due to new income, the payout button will become available again.

What is a correction invoice?

Multi-platform

Multi-platform is for flex workers who work for more than one platform. It enables you to add multiple platforms to the Payday App, so you can use our benefits on all the platforms you work for.

Note that the platform you want to add must be connected to Payday. Does the platform you work for not use Payday and do you want to be paid immediately? Then let them know about us! You can forward this link.

What is multi-Platform?

Since we are working with different platforms, we want to keep everything separate from each other. You can pay out your hours per platform, but you cannot pay them out all combined over the platforms. In the Payday App, go to “Settings” and click on “My Platforms”. Here, you can choose which dashboard you want to go to, to manage your finances. The Payday App remembers this choice for the next time you log in.

How do I switch amongst my platforms?

If you have received a unique code from your platform to register with Payday, you can add it under "Settings" and "My Platforms". The unique code creates a new dashboard and does not replace your current dashboard(s).

The platform you work for may not be connected to Payday. Unfortunately, we cannot add that platform to our App because of this. Do tell them about us!

How can I add a platform?

Settings & Personal Data

You use your Payday PIN code for your daily login. You can change the 5-digit PIN in the Payday App under “Settings” and “Change login code”.

How can I change my PIN?

Your Payday password is the password that secures your account. You only use this password if you have forgotten your PIN and use it in combination with your e-mail address. If you have forgotten your password, you can change it at the bottom of the login screen. Go to “Forgot your password?” and enter your email address. If the email address is known, you will receive an email with the option to create a new password. You will create a new PIN too after creating a new password.

I forgot my password. How can I change it?

Yes! You can set the Payday App to be available in Dutch or English. You do this at “Settings” and “Language”.

Can I set up the Payday App in different languages?

We fetch the data from your profile at the platform you work for. If you change your details there, those details will Appear on your profile in the Payday App within two working days.

Where can I change my personal information?

If you have a new account number, you can change it according to the procedure of your platform. You will be notified via Paydays push notifications when the request has been received and when the change has been processed. That new account number will be shown in the Payday App within two working days. Before payout, please check if the correct IBAN is in your profile. You can find this under “Settings” and “Personal information”. If it is not correct after two working days, please contact your platform for further assistance.

Is a transaction paid to your old account number, and is this account number no longer active? We will then retrieve this amount from the receiving bank and request your platform to collect a new - working - IBAN from you, so that you still receive your money.

How can I change my IBAN?

Your email address is used as your unique ID. It is not possible to change your email address on your current account.

Can I change my email address?

Payday meets ABN AMRO's strict security requirements. If you want to know more about what personal data we have and how we handle it, read the privacy statement.

Is my data safe?

Support

If you are concerned about the details of your earnings, we recommend that you contact your platform. Payday visualizes information that we collect and fetch from your platform, but we have no influence on the specific content. Contact your platform, we will then investigate it with them.

My hours, services or invoices are incorrect. What now?

There may be a hiccup. Do not worry, your money is safe. We will automatically retry your transaction every five minutes. The platform you work for may have set a limit on the number of payments per day. If you exceed this limit, it may take a little longer than you are used to from us to get your money. Contact your platform if you have not received your earnings one working day later.

Has your IBAN changed recently? Then this request may still be pending. As soon as this change has been Approved by your platform, your payment will reach you. When payments are transferred to an incorrect or deactivated bank account number, we will retrieve this payment from the receiving bank. In that case, we will contact your platform to collect a working IBAN to ensure your money is still coming your way.

What can I do if my transaction has been confirmed, but I have not received any money?

No problem. If we see that an amount has been credited, we investigate why this is happening. If this payment ends up with us incorrectly, we will refund it. Does the refund take longer than two working days? Then contact your platform for additional support.

I accidentally transferred money to Payday. What now?

We are sorry that you are experiencing issues with the Payday Application. If there is a malfunction, we will do everything we can to solve it. If you need further support, please contact your platform.

I get an error message when I use Payday. What now?

If your question has not yet been answered, it is best to contact the platform you work for. Do you have additional questions about a specific Payday transaction? Please reach out to payday@nl.abnamro.com.